florida sales tax on boat repairs

Taxpayer provides yacht charter services with crew furnished by the owner. 12A-1071 Florida Administrative Code FAC QUESTION.

Florida Marine Boat Services And Dealers For Sale Bizbuysell

TIPs are posted at.

. Floridas Sales and Use Tax GT-800013 Floridas Discretionary Sales Surtax GT-800019 Florida Annual Resale Certificate for Sales Tax GT-800060 Information forms and tutorials are available on our website. Depending on which county the boat is delivered to Discretionary Taxes come into play. Florida has recent rate changes Thu Jul 01 2021.

Subsequent and separate repairs are each subject to their own 60000 cap. A repair person who is registered as a sales and use tax dealer may purchase materials and parts tax-exempt if. The Florida state sales tax rate is 6 and the average FL sales tax after local surtaxes is 665.

Otherwise no sales or use tax is due for a boat that is purchased outside of FL and subsequently registered in FL. However if you purchase a used boat from an individual even if on consignment through a dealer and the itemized invoiceBOS includes other items outboard trailer etc then the FL tax collectors agent will likely. Florida charter boat exempt.

1 a Effective September 1 1992 notwithstanding the provisions of Chapters 327 and 328 FS pertaining to the registration of vessels a boat upon which sales or use tax has not been paid is exempt from the use tax if it enters and remains in this state for a period not to exceed a total of. Sales and Use Tax TAA 17A-012 Boats. Subsequent and separate repairs are each subject to their own 60000 cap.

Sales and Use Tax. For sales tax purposes a boat dealer and yacht broker are the same. Also offers boats for sale but may or may not have the boats in its possession.

TMW Yacht Sales Inc. Select the Florida city from the list of popular cities below to see its current sales tax rate. Related the maximum tax Florida requires on the repair of a boat or vessel is 60000 for each repair with separate or subsequent.

In the state of Florida sales tax is legally required to be collected from all tangible physical products being sold to a consumer. Florida Department of Revenue Sales and Use Tax on Motor Vehicles Page 1. FLORIDA TAXES State SalesUse Tax 6 Discretionary SalesUse Tax 0 - 75 Depending on County NOW CAPPED AT 1800000 Per Boat Property Taxes on Boats None Florida Issues Titles on Boats that are Not Documented Documented Boats Are Required to be Registered CRUISE FLORIDA TAX FREE FOR 180 DAYS.

Some might be a little more and others a little less but Florida has a flat sales tax rate of 6. When parts are furnished by a repair person sales tax is due on the entire charge made to the customer for adjusting applying installing maintaining remodeling or repairing tangible personal property unless specifically exempt. For more information and detailed instructions on this maximum tax see TIP 15A01- 07 issued on.

12A-10071 Boats Temporarily Docked in Florida. BOAT CAR PLANE DEALERS. This figure includes all sales and use tax plus discretionary sales surtax.

Floridas general state sales tax rate is 6 with the following exceptions. You keep the boat in FL for over 90 days. A new Florida law that takes effect July 1 limits the sales tax paid on repair and renovation of a boat to 60000 or the first 1 million of the refit.

The state sales tax rate in Florida is 6000. Sales tax is added to the price of taxable goods or services and collected from the purchaser at the time of sale. All boat sales and deliveries in this state are subject to Floridas 6 percent sales and use tax unless exempt.

TIPs are posted at. FL SALES TAX 60K CAP ON BOAT REPAIRS published December 7 2018 by David J. Several examples of exceptions to this tax are certain groceries any prosthetic or orthopedic instruments remedies considered to be common.

Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Florida local counties cities and special taxation districts. With marine-related competition for the repair and refitting of vessels now heating up in the Caribbean Latin America and Europe MIASF has taken an active role to ensure that South Florida remains the global marine hub. Definitions Motor vehicle An automobile motorcycle truck trailer semi-trailer truck tractor and semi-trailer combination or any other vehicle operated on the roads of Florida used to transport.

The cap was effective as of July 1 2015. 4 on amusement machine receipts 55 on the lease or license of commercial real property and 695 on electricity. If a salesuse tax were due it would be 6 of the purchase price capped at 18K less any amounts paid towards sales taxes in another state.

Department of Revenue Florida Department of Revenue DOR 02-9-FOF December. Sales and Use Tax TAA NUMBER. This cap is to be applied to each boat repair occurring in Florida.

The maximum tax on the repair of a boat or vessel is 60000. Join 16000 sales tax pros who get weekly sales tax tips. Those prices range from 05-15 but cap at 5000.

The absolute maximum tax you can pay on the sale of a boat or vessel in the state of Florida is 18000 as of 2018 state tax rates. All other activity with the boat including its movements for boat shows and repairs were considered to be in the scope of bare boat operations. Florida collects state sales tax on most material purchases as well as on the rental of housesapartments rental of material goods admissions fees and services such as.

Taxpayer requests confirmation that. To speak with a Department representative call Taxpayer Services at 850-488-6800 Monday. The maximum tax on the repair of a boat or vessel is 60000.

Signed into law by Governor Scott the 60000 tax cap eliminates sales taxes on boat repairs that cost more than 1 million starting July 1 2015. Generally Florida boat dealers and yacht brokers must collect sales tax from. FL SALES TAX VS DMV - BOAT WITH OUTBOARD MOTOR published May 3 2015 by James Sutton CPA Esq.

For more information and detailed instructions on this maximum tax see TIP 15A01 -07 issued on. Sales taxes and caps vary in each state. Boats purchased from an individual should be taxed on the hull only if the hull is itemized on the invoicebill of sale.

On June 16 th Florida Governor Rick Scott signed a bill into law which places a cap on the sales tax of 60000 for any boat repairs in excess of 1 million and are completed within the State. This cap is to be applied to each boat repair occurring in Florida. 21221 Florida Statutes FS RULE CITES.

What transactions are generally subject to sales tax in Florida. With local taxes the total sales tax rate is between 6000 and 7500. FL SALES TAX FORMS published June 14 2013 by Jerry Donnini Esq.

If you are looking into a superyacht purchase the cap for sales tax in Florida is.

Florida Boat Lien Southern Title Liens

How To Register A Boat In Florida With No Title Detailed Guide

Fl Sales Tax Vs Dmv Boat With Outboard Motor

9 Things To Consider When Buying Or Selling A Yacht In Florida

Watercraft For Sale In Miami Fl Marine Dealer

Schumann Bavaria Germany Floral Design And Gold Trim Gravy Boat With Under Plate Schumannbavaria Bavaria Germany Fun Plates Floral Design

Jet Boats For Sale In Miami Fl Boat Dealer

Bayliner Element Ski Arch In 2022 Boat Covers Outboard Bay Boats

New 2021 Xpress H190b Power Boats Outboard In Perry Fl Stock Number Dealer Url

Boating Boom During Covid Biscayne Times

Used Boats For Sale In Miami Fl Used Boat Sales

Best Boat Insurance Calculators Boat Insurance Best Boats Boat Safety

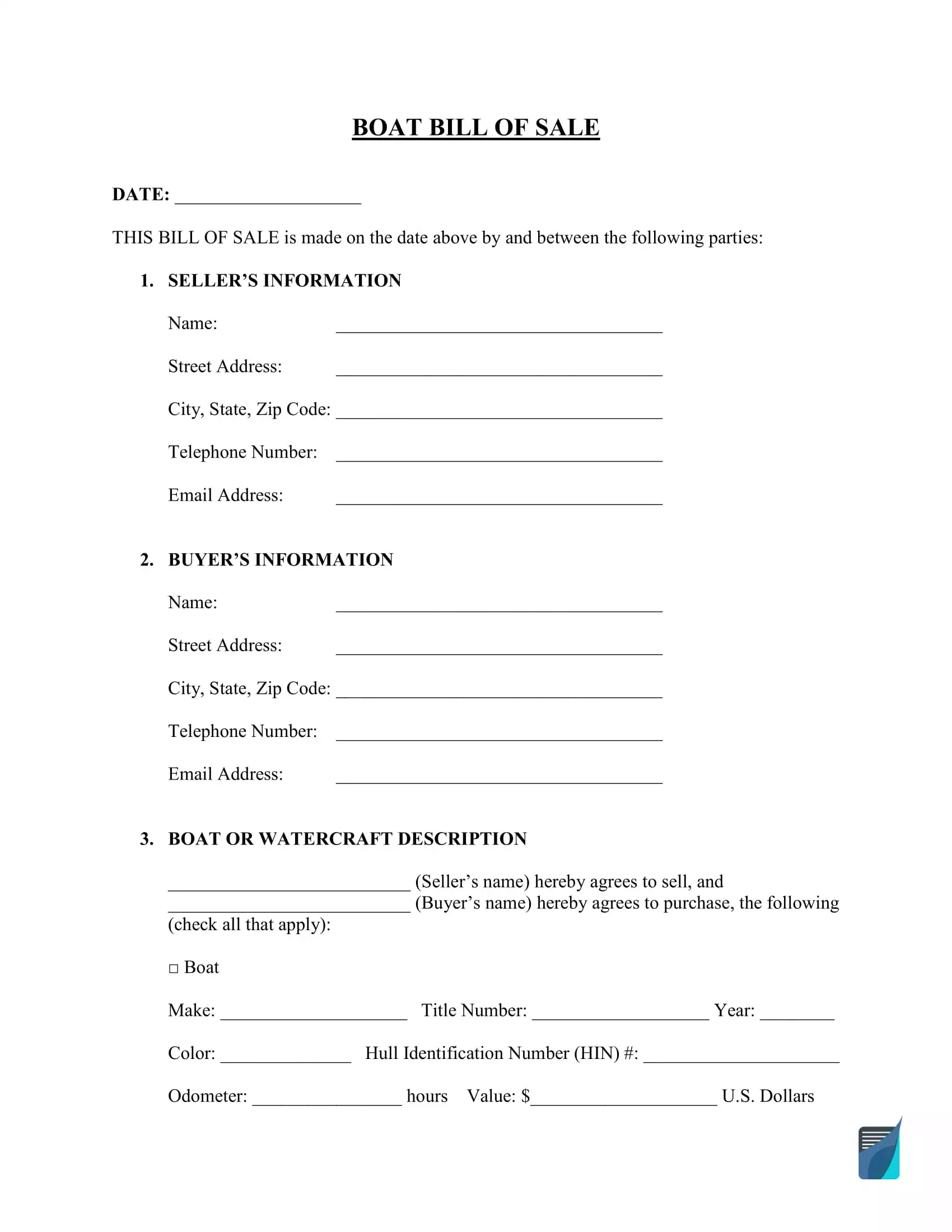

Free Florida Boat Bill Of Sale Form Pdf Formspal

2020 Yamaha Ar240 Riva Motorsports Marine Of The Keys

Legendary Marine Orange Beach Boats For Sale In Florida Alabama Legendary Marine Florida Boat Dealer Full Service Provider

How Much Does It Cost To Own A Boat Mount Dora Boating Center Marina Mount Dora Florida

Fl Sales Tax 60k Cap On Boat Repairs

Yamaha Center Console Boats For Sale Miami Fl Jet Boats

How To Register A Boat In Florida With No Title Detailed Guide