portability of estate tax exemption 2019

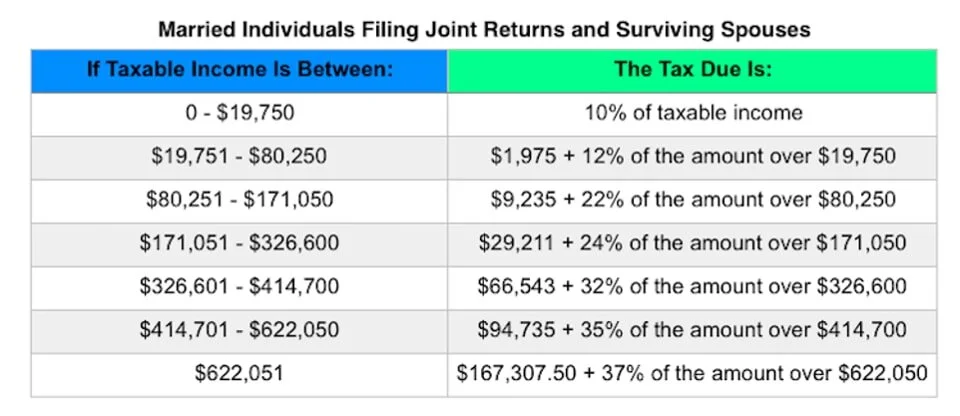

Surviving spouses now have a longer window to benefit from unused gift and estate tax exemption of their dearly departeds estate. Joan died in 2019 when the married filing jointly estate tax exemption was 228 million.

Great News For Those Missed The Portability Filing Deadline Karp Law Firm

It is more polite to refer to this as the portability election The unused exemption may be used by the surviving spouse for both gift and estate tax purposes in.

. In Maryland a law introduced in 2014 gradually increased the estate tax exemption every year until the year 2019. Noras estate is subject to tax on 295 million 40 million less her exemption and Nicks exemptions for a tax liability of 118 million. The government allows an estate tax.

Thanks to the annual federal gift tax exclusion 15000 for 2018 and 2019 both you and your spouse can make annual gifts to a single recipient up to that amount and reduce the taxable. The first 1206 million of. It is only available to.

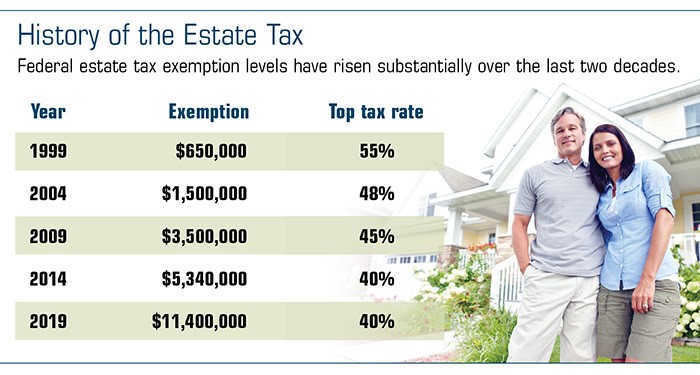

Since Joan and Mark are married they are eligible for the portability rules. The 2019 federal exemption for gift and estate taxes is 11400000 per person. 2019 Changes to Estate Tax Exemption Maryland.

The biggest shortcoming of federal estate tax exemption portability is the loss of asset protection by not utilizing a credit shelter trust in a revocable living trust or Will. AgingCaring for Aging Parents Blog. Federal Estate Tax.

There is also a federal estate tax you may be subject to but it has a much higher exemption. What You Need to Know About Estate Tax Exemption. If making a portability election a surviving spouse can have an exemption up to 228 million.

Had Nicks estate plan placed 525. Portability is a way of transferring the amount of the gift and estate tax exemption that a deceased spouse did not use to the surviving spouse. Portability can be used to protect the surviving spouse from having to pay steep gift or estate taxes upon a spouses death.

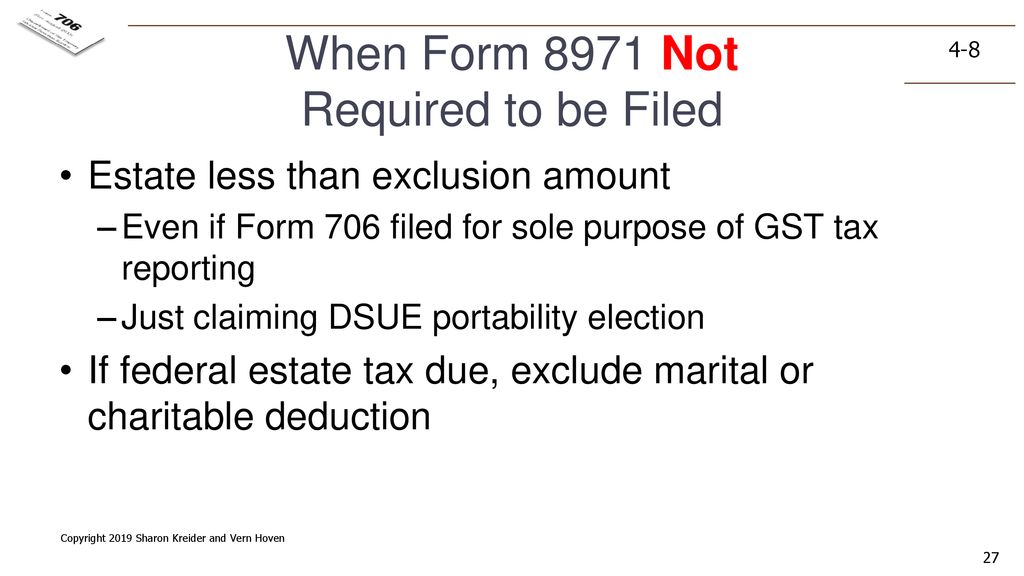

This doesnt mean your estate automatically pays taxes after you die. Portability Federal Estate Tax Exemptions. On July 8 2022 the Internal Revenue.

Foreseeing the inflation the TCJA has set. 26 rows The 2022 exemption is 1206 million up from 117 million in 2021. The tax cuts and jobs act increased the exclusion significantly.

The 2019 federal estate tax exemption will be 114 million. The tax exemption change works with the federal gift and estate tax where the TCJA act doubles the existing exemption from 5 million to 10 million. The federal estate tax exemption is 1206 million in 2022.

Note that with regard to state estate taxes currently only Hawaii offers portability at the state level and Maryland will begin offering portability of its state estate tax exemption at the. 4 rows Portability of Unused Estate Tax.

Relief From Irs Portability Of Lifetime Tax Exemption Extended Wilchins Cosentino Novins Llp Wellesley Ma Law Firm

Estate Tax Exemption Attorney Era Law Group

How Do The Estate Gift And Generation Skipping Transfer Taxes Work Tax Policy Center

Irs News Federal Estate Tax Exemption Portability

West Palm Beach Tax Elder Law Possible Estate Tax Law Changes And The Portability Election

Estate Tax Exemptions 2020 Fafinski Mark Johnson P A

Irs Increases 2020 Estate Tax Exemption Postic Bates P C

Deceased Spousal Unused Exclusion Dsue Portability

Irs Now Allows For 5 Year Estate Tax Portability Election

Overview Of 2019 Estate Exemptions Tax Epilawg

Historical Estate Tax Exemption Amounts And Tax Rates 2022

Stu Law Tax Law Symposium 2019 Panel 3 Federal Estate And Gift Tax Youtube

Estate Planning Duvall Wheeler

Estate Tax And Gift Tax Exemptions For 2021 Burner Law Group

Form 706 Extension For Portability Under Rev Proc 2017 34

How Many People Pay The Estate Tax Tax Policy Center

What Spouses Need To Know About Portability Of The Estate Tax Exemption